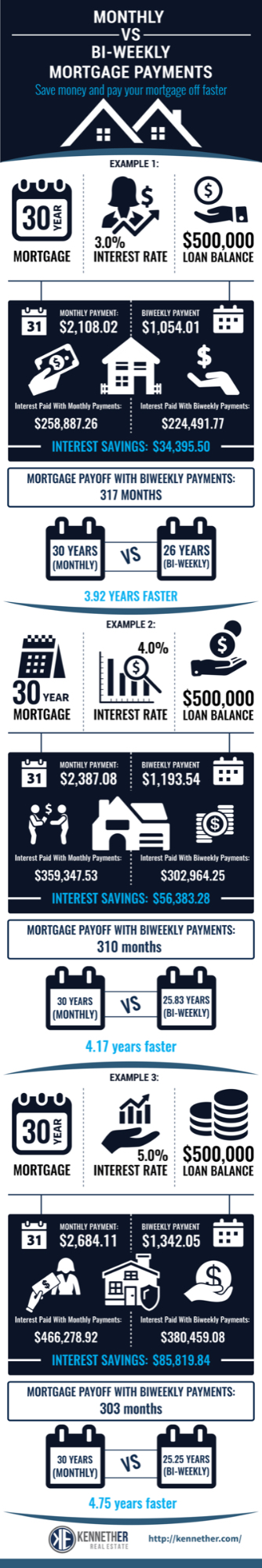

If you are like many homeowners, you pay your mortgage once a month either by mailing a check or through automatic payments. There is nothing wrong with this route, except your 30 year mortgage is actually a 30 year mortgage. What if I told you that you could pay your mortgage off years earlier by making biweekly payments instead of monthly payments.

The concept behind biweekly payments is simple. There are 12 months in a year and if you are making regular payments, you would make 12 payments. There are 52 weeks in a year and if you are making biweekly payments, you would make 26 payments or the equivalent to 13 monthly payments. That one extra payment a year is what will shorten the length of your mortgage.

Because you are making your payments every two weeks versus every month, you are reducing your principal balance quicker and therefore the amount of interest you are paying on your mortgage balance.

You are paying more towards your mortgage each year so it is not like your mortgage magically gets paid off faster. But if you are like many workers, you get paid every 2 weeks. You can potentially schedule your biweekly payments so that they are made after you receive your paycheck.

The higher the interest rate your mortgage is, the more this payment method will help. Again, most homeowners now are fortunate enough to lock in a low interest rate loan or refinanced into something lower, but we all know that is not going to stay around forever. Higher interest rates are inevitable.

If you want to see what your savings would be you can check out the calculator here. As always, if you have any questions or need some assistance, I am here to help.