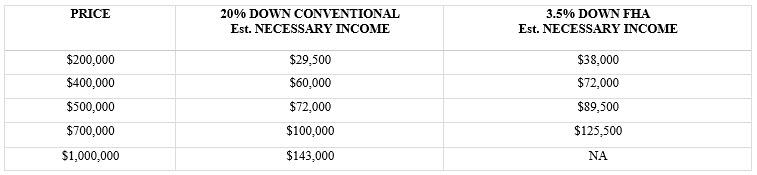

REALISTIC GOALS BASED ON INCOME AND DOWN PAYMENT PARAMETERS

One of the primary jobs of our Mortgage Analysts is to ensure borrowers have realistic home-buying goals.

For example, a buyer with $6,000 of monthly income should not be looking to buy in a $700,000 neighborhood unless she has over $300,000 of down payment funds.

Realistic considerations are especially important now that rates and housing payments are increasing.

The below table sets out minimal estimated income requirement for various price points for both Conventional and FHA purchases.

The above table represents rough estimates only, and all the numbers are rounded. Assumptions include a conservative “no points” rate of 4.75%, a 1.25% property tax rate, and minimal consumer debt.

There are many other variables that could impact qualifications, but the table nonetheless provides an educational approximation of necessary income levels.

This article original appeared on jvmlending.com and was written by:

Jay Voorhees at 925.855.4491

Real Estate Broker, CA Bureau of Real Estate, BRE# 01524255, NMLS# 335646