In November of 2013, the Consumer Financial Protection Bureau (CFPB) issued its final rule to integrate the Real Estate Settlement Procedures Act (RESPA) and the Truth In Lending Act (TILA) disclosures and regulations. These changes are the biggest change to the real estate industry in over 20 years and will affect anyone buying, selling, or refinancing a home starting October 3, 2015. If you are in contract before the October 3rd initiation date, you will follow the old procedures. If you are in contract on or after October 3rd, these new rules will apply to you.

The purpose of the new rules is to make the loan process clearer for the consumer. The new forms will put the most relevant information in an easy to read format so there is no confusion to the consumer as to what type of loan they have, interest rate, what their monthly payment is and how it breaks down, and much much more. These disclosures and forms need to be in front of the borrower within a certain amount of time and a certain number of days allotted for the borrower to review before the process can continue forward.

With the new system being so new, it will cause inevitable delays to the closing process. Our typical 30 day close may turn into 45 days or more. Long gone are the days where last minute changes and credits can be applied. Every time there is a change to the disclosures, the time starts all over again. These new requirements will widen the gap between great lenders, Realtors, and escrow officers and mediocre ones. Efficient lenders will be able to adapt to the new systems easily and working with a great Realtor will keep everyone on the same page and updated throughout the entire process.

Below I have summarized the changes to the Loan Estimate and the Closing Disclosure. These are the most important changes and there is still much more that I have to learn and will share any other relevant information with you.

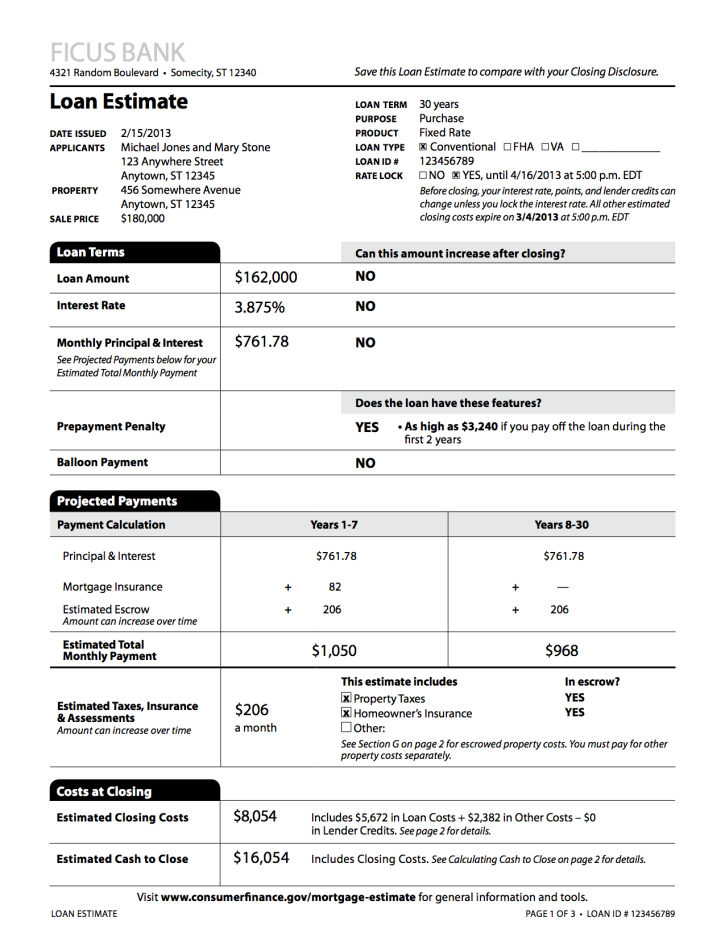

Loan Estimate

The Loan Estimate will be extremely for the borrower to read. All the important information will be on the first page. The Loan Estimate will be provided to the borrower within 3 days of applying for the loan. The Final Loan Estimate must be delivered to the borrower 4 days before the close of escrow.

At the top, the borrower will be able to see the following:

-

Name

Income

Social Security Number

Property Address

Purchase Price

Loan Amount

Below that, the borrower can find details about the loan including:

-

Interest Rate

Monthly principal and interest

Pre-payment penalty (if applicable)

Estimates for insurance, property taxes, and assessments

Use of impound accounts

Estimated closing costs

Amount of cash required to close

The pages following will go into details about the costs summarized on the first page. See an example of the Loan Estimate below. Click on the image for a full sample of the Loan Estimate.

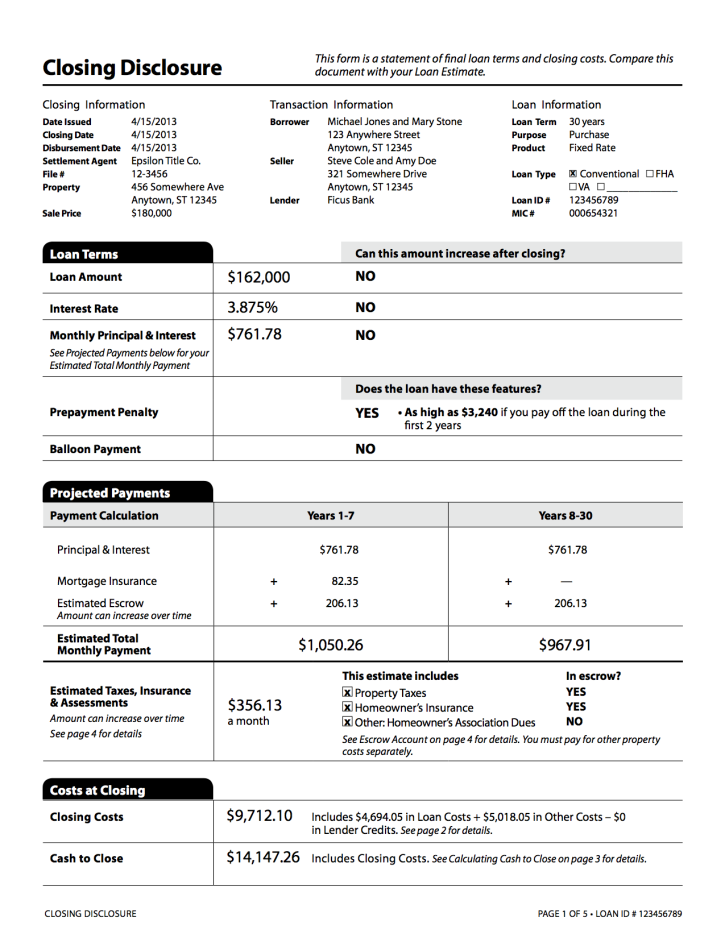

Closing Disclosure

The Closing Disclosure (CD) will replace the Final Truth-in-Lending Disclosure and the HUD-1. Just like the Loan Estimate, the Closing Disclosure will make the most important information easy to read and will be provided to the borrower a minimum of 3 days before closing. Any changes to the Closing Disclosure will result into the 3 day holding period to start over again and possibly delaying the close of escrow. An example of the closing disclosure can be seen below. Click on the image for an example of the entire closing disclosure.

The first page of Closing Disclosure is very similar to the Loan Estimate and the cost to close should match the Final Loan Estimate. In the Closing Disclosure, anything that is marked “YES” will be detailed in the preceding pages. Additional pages in the closing disclosure will detail costs and how they were allocated. Some examples are:

-

Loan Costs

Services You Cannot Shop For

Services You Can Shop For

Taxes and Other Government Fees

Escrow Fees

Other Costs

Seller Paid Costs

Buyer Paid Costs

Adjustments and Prorations

I hope this has been informative. If you have any questions, feel free to contact me.